Manage My Money is a personal financial management tool that enables you to bring your different finances together, even if they are held outside of Main Street Bank. With Manage My Money, you have access to a single location where you can view and manage your finances. Secure and free for Online and Mobile Banking users, Manage My Money brings the many parts of your personal finances together to enable anyone to budget, plan, and save easily.

Features & Benefits:

Connect to your Accounts

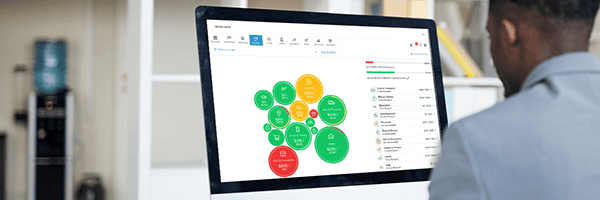

- Add accounts from different financial institutions, like banks, credit unions, credit cards, investments, and more to see a full picture of your finances.

- View balances on checking, savings, investments, credit cards, mortgages, and other loans.

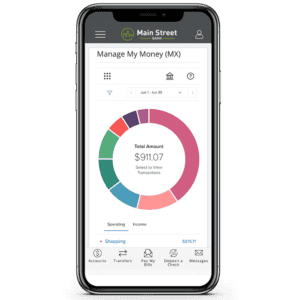

Track Spending

- View your transactions in real-time.

- See a full breakdown of your spending over a specific period.

- Create a monthly budget based on account activity.

Set Goals

- Create goals for savings, debt payoff, and more.

- Track your progress on goals over time.

How to Use Manage My Money

Access Manage My Money for free with Main Street Bank’s Mobile Banking app and Online Banking.

Why Use Manage My Money

Keeping a budget is an important part of your financial health, but between tracking expenses and logging entries, traditional methods of budgeting can become burdensome. When faced with such an energy and time commitment, it’s easy to push budgeting aside. With this tool, you can remove the obstacles to effortlessly pursue healthier financial habits.

Manage My Money works by securely accessing your various financial accounts and bringing them together under one centralized platform. Additionally, transactions are grouped into categories so that you can easily track where your money is going. Your budget practically builds itself. You can manage all your finances from one secure platform, entirely free of charge. With just a glance, you know that your budget will accommodate a purchase, or if you should wait until your next paycheck. No more guessing, and no more estimating. It’s really that easy.