You may think that saving money is as simple as setting money aside in a bank account, investments, or sock drawer (please, don’t use the sock drawer.) In reality, a comprehensive and successful savings plan should have a strategy and follow a specific formula.

The Triangle Form Savings Plan

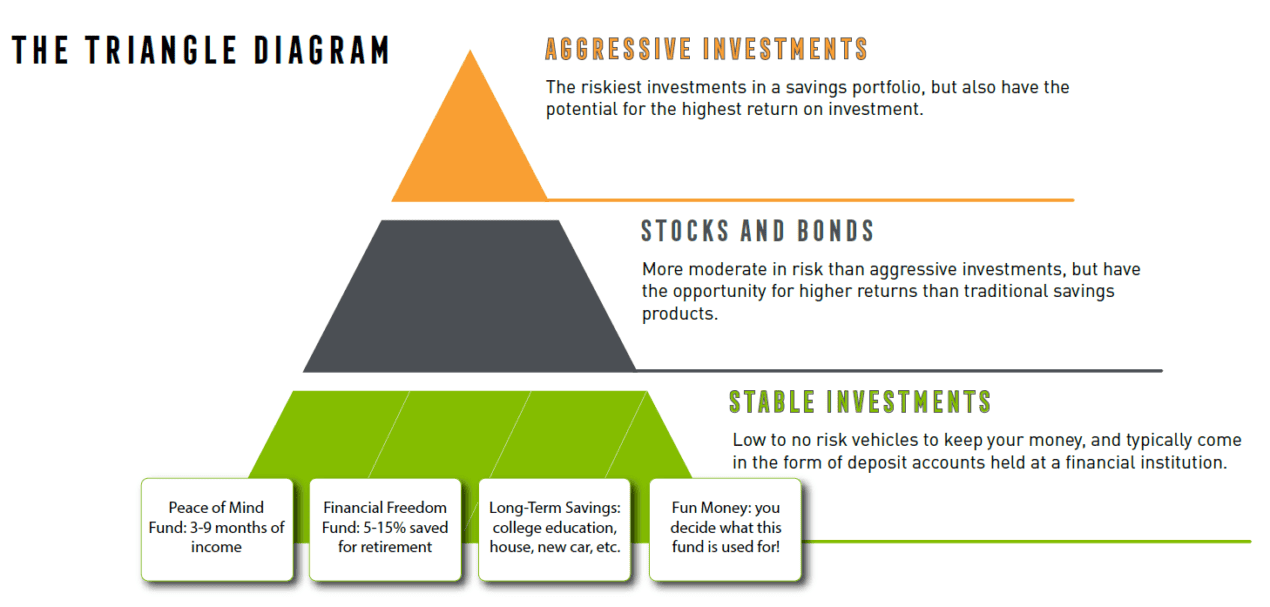

The “Triangle Form” savings plan is based on the psychology of investors who tend to perform well in their long-term goals, and one we recommend to our customers. As the name suggests, the Triangle Form is made up of 3 main parts: aggressive investments, stocks and bonds, and stable investments.

Three Parts of the Triangle

First, the top and smallest part of the savings triangle represents aggressive investments. These are the riskiest investments in your portfolio, but also have the potential for the highest return on investment. These types of investments should account for the smallest percentage of your overall savings. Most importantly, you should consult a financial planner about what investments make the most sense for you.

Next, the middle portion of the triangle represents stocks and bonds. These investments are more moderate in risk, but have the opportunity for higher returns than traditional savings products. These investments contribute to your savings plan. Again, it is important to work with a trusted financial advisor to help you pick the right options for your unique situation.

Finally, the base and largest area of the triangle represents your stable investments. These are low to no risk savings vehicles to keep your money in, and typically come in the form of deposit accounts at a financial institution. For instance, checking accounts, savings accounts, money markets, and certificates of deposit (CDs) are useful tools for saving money.

A Closer Look at Your Stable Investments

Consider the base of triangle, as shown in the diagram. Your stable investments are divided into four main categories:

- Peace of Mind Fund

- Financial Freedom Fund

- Long-Term Savings

- Fun Money

Peace of Mind Fund

This is your “in case of emergency” account. Ideally this should contain anywhere from 3 to 9 months’ worth of income and can be withdrawn easily in case of an unexpected expense, such as an injury, illness, or other disaster. When an emergency arises, you will need quick access to these funds. That is why this money should be kept in a liquid account, such as a traditional checking account, or accessible savings account. These funds should not be kept in a certificate of deposit (CD), since those accounts are typically tied up for a set term.

Financial Freedom Fund

Everyone dreams of having financial freedom one day, and this is normally what we envision when we think of retirement. Your financial freedom account should be non-negotiable. In other words, you should pay yourself into this account first before putting money anywhere else. You should aim to save 5% to 15% or more of your income towards this fund. In the case of some 401K or Individual Retirement Accounts (IRAs), these funds can sometimes be tax-free or tax-deferred. Talk to a licensed accountant to verify what types of accounts may be tax-free or tax-deferred for you before deciding which account type to open.

Long-Term Savings

Your long-term goals are important to a well-rounded and fulfilling life, and everyone’s goals are unique. Allocate these funds for your future, such as purchasing a home, a college education, an additional fund for retirement expenses, a new car, or more. These funds are best kept in an account you cannot access until you are ready to reach that savings goal. Your personal banker will be able to help you select the right term account to save up for these life milestones.

Fun Money

It would be unrealistic to expect you to never spend money on yourself or the things you enjoy (not to mention, it would be pretty boring!) Therefore, a solid savings plan includes your immediate goals, hobbies, or interests. Your fun money account is meant to be used how you want to, typically every 3 to 4 months. An effective strategy is to set up a separate account for your fun money that does not mix in with your day to day and regular expenses account.

What To Do Next

You may already have a savings plan in place, or you may be brand new to the process. Either way, you’ve nailed the first step by educating yourself further. The next step is to make sure you are allocating the right percentages into each of these savings categories. This is where a personal banker can help. They will create a total inventory of all your savings accounts by balance, account type, maturity date, and goal, and show you where there may be gaps in your savings plan.

Talk to one of our experienced personal bankers today for a complimentary review of your savings accounts.

Connect with a Personal Banker

Would you like to receive more information from us? Sign up for our email newsletter to get the latest news, announcements, and information from Main Street Bank.

Please enable javascript to register.