How to save with CDs

Certificates of Deposit (CDs) are savings accounts that you open with a financial institution. These accounts help preserve and grow your savings because they don’t carry the same risks as non-deposit investment products, such as stocks.

When you open a Certificate of Deposit, you entrust the balance of the account to the financial institution for the length of the account term. In return, you earn interest on the account balance according to the interest rate for the account term at the time it was opened.

Certificates of Deposit are an essential deposit product for a well-balanced and secure savings plan. After reading this article, you will better understand the benefits and tradeoffs of CDs and be prepared to easily incorporate CD accounts into your savings plan.

Understanding Certificate of Deposits’ Benefits and Caveats

Certificates of Deposit have benefits as well as tradeoffs. One benefit of a CD is its consistent return on investment. When you open a CD, you choose the term, usually timed in months, at the interest rate offered by the institution at the time of account opening. Once opened, the CD will accrue interest at that interest rate for the full term of the account. This guarantees that you will see a return on your savings regardless of any changes to the interest rate environment. This stable interest rate is what makes CDs so important for your savings plan. In addition, deposits held at Main Street Bank are insured by both the FDIC and the DIF, ensuring that your savings grow risk-free through your account term.

The compromise with CDs is that once you lock into an interest rate at a specific term, you need to wait until the end of the term to withdraw your savings. Otherwise, you will receive an early withdrawal penalty. This means that you should consider when your CDs mature and have other methods of funding if you run into financial need while your CD is locked. However, there are strategies you can implement to help.

Certificate of Deposit Maturity and Renewal

After the length of your account term, your CD enters its maturity or renewal period. During this window, you can make changes to your account without penalty, including withdrawing or adding funds, changing the term, or closing the account. If you don’t make any changes during the renewal period, then your account typically renews for the same term length at the current interest rate offered. Your account maturity is when you should consider your savings and decide if you want to make any changes.

Strategies for Saving with Certificates of Deposit

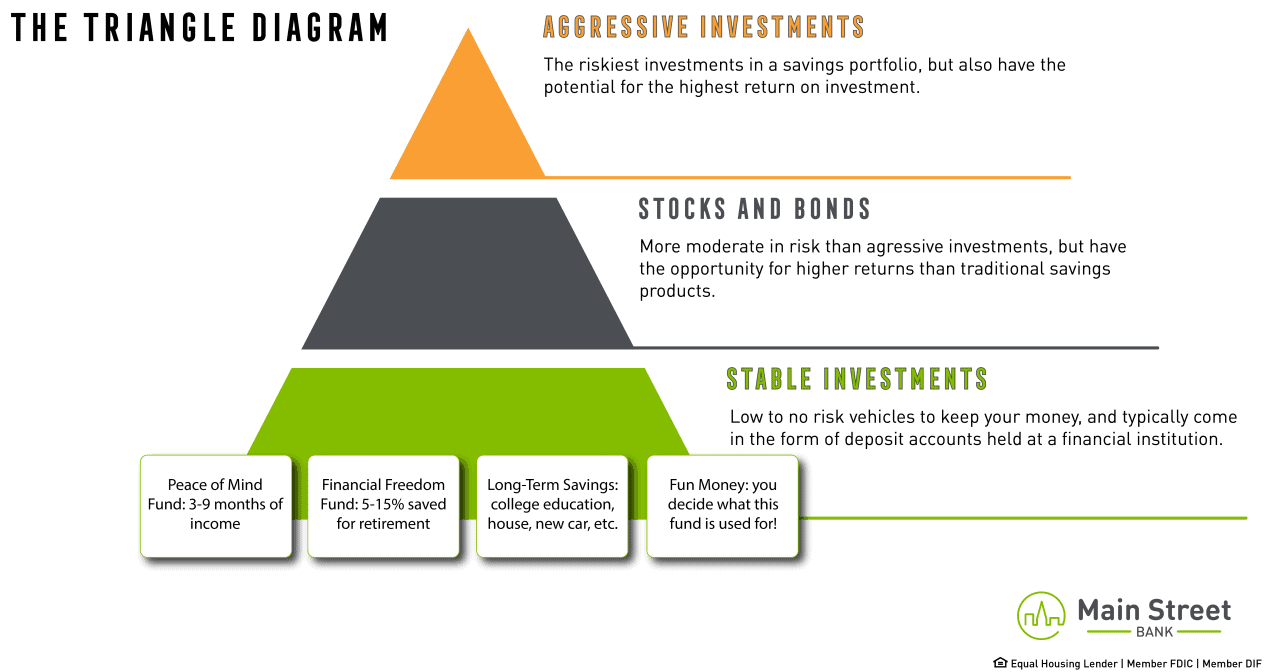

The triangle savings plan is one of the most well-known savings plans. This method of saving has few risky investments, a medium number of moderate-risk investments, and a foundation in low-risk savings. Building your savings foundation with low-risk investments such as CDs, traditional savings accounts, and IRAs anchors your savings against uncertainty. In times of market volatility, your high-risk investments could yield large returns or diminish in size significantly. Controlling your risk makes for a stable investment plan that will help you keep hold of your hard-earned savings.

Laddering CDs

The main downside of CD accounts is that your funds are effectively inaccessible during the length of the CD term. A strategy known as “laddering” makes it easier for you to withdraw your savings throughout the year. You can ladder CDs by opening multiple CD accounts that renew at different times throughout the year. Timing these renewal periods throughout the year gives you more chances to access your savings when you need the cash. Laddering your CDs is an effective way to make your savings more accessible while still taking advantage of the stable investment that CDs provide.

Earmarking CDs

If you have a specific expense that you anticipate paying at a future date, then you could consider opening a CD and earmarking those funds for that specific purpose. Make sure that your CD matures before your funds are needed to ensure that you are ready to pay for that expense. Earmarking CDs can help you earn interest on the money that you were already going to spend and makes that expense easier to budget. Some good ideas for an earmarked CD could be for a vacation, a yearly insurance payment, or holiday gift shopping. Many financial institutions will let you add nicknames to your financial accounts as well so you can label your different CDs directly in online or mobile banking.

In Closing

There are many different ways to save money using CDs. A secure and reliable savings method that makes your money work for you. Pay attention to when your CDs mature and save with purpose, and you are right on your way to strong, stable investing.

We are here to help you learn and grow your savings. Reach out to a personal banker any time if you have questions about your finances. We are here to help!

You can view our CD offerings here, and open an account in person, online, or face-to-face with an experienced banker through Video Connect.